Most clients in Poland choose equal installments. Why? The answer is simple: they want to have mortgage monthly payments which are as low as possible. They also usually choose a thirty-year mortgage term.

Clients who can afford to pay more every month for their mortgage sometimes consider decreasing installments. Their goal is to pay as little as possible of the interest for the mortgage loan. At first sight it’s a good idea.

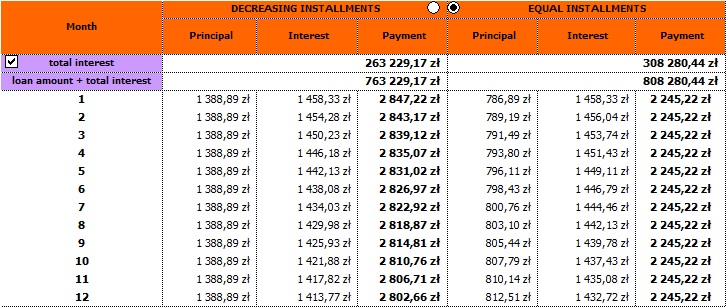

Let’s look at an example:

Loan amount: PLN 500.000

Interest rate: 3.5%

Term: 30 years

If you choose decreasing installments your monthly payment will be higher for the first years comparing to equal installments but you will pay less interest at the end of the term.

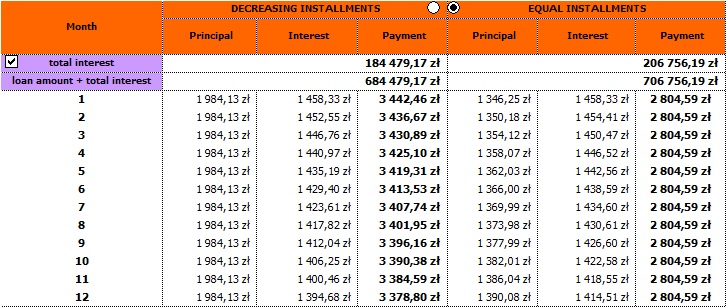

At first sight it’s a good idea to choose decreasing installments if having PLN 2800 of monthly payment is not a problem. But if it is so, why not choose equal installments and shorter term? If your goal is to pay less interest at the end of the term and paying PLN 2800 is not a problem why not pay this amount for the entire term of the mortgage.

Term: 21 years

If paying monthly PLN 2800 is not a problem you can take a mortgage for 21 years with equal installments and you will pay even less interest at the end of the term.

Let’s sum up:

There is also another approach to this. Maybe it’s a good idea to choose equal installments for 30 years? Why? It is safer. You can choose equal installments for 30 years with monthly payment at about PLN 2250 and save PLN 600 every month. If you have any financial problems in the future (e.g. you lose your job) you will have lower monthly mortgage payments and you will have savings in your savings account. Additionally you can also use your savings and make an overpayment from time to time. It will lower your total interest paid to the bank over the lifetime of the loan.

On the other side maybe you predict that your earnings will be lower or your expenses will be higher in the future? In this case decreasing installments make sense. Everyone’s circumstances are different and everyone has different approach to life. That’s why everyone should choose what is the best for him or her and that’s why it’s good to know the options and pluses and minuses of every option.