There are two main methods of repaying a mortgage loan:

What are capital and interest?

This is the traditional and the most popular mortgage repayment option. In this repayment method every month you are paying off a little of the capital and a little of the interest until the full debt is repaid.

Banks in Poland offer two methods of capital and interest repayment:

The capital is divided into equal parts and interest are charged on outstanding loan. Thus capital repayment is equal every month and interest payment is different (lower) every month. As a result of this monthly payments decrease – every next monthly payment is lower than previous.

In this method bank uses a special formula to determine monthly payments. Capital repayments and interest payments are different every month but total monthly payments are the same every month (provided that the interest rate doesn’t change).

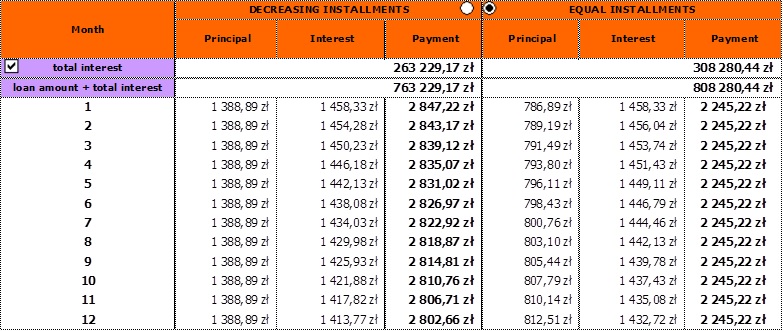

The best way to show the difference is with an example:

Loan amount: PLN 500,000

Interest Rate: 3.50%

Term: 30 years (360 months)

(Principal=Capital)

As you see in the above table decreasing installments are cheaper than equal installments (you pay less interest at the end of the term) but monthly payments will be higher for the first several years.

Which method is better? The answer is not that simple and obvious. This is the subject for the next article: Equal vs. decreasing installments